Client Profile

An educational nonprofit organization aimed at improving financial literacy among high school students sought a reliable way to teach practical budgeting skills in the classroom. They wanted to provide students with real-world financial scenarios using realistic but customizable bank statements.

Client’s Needs

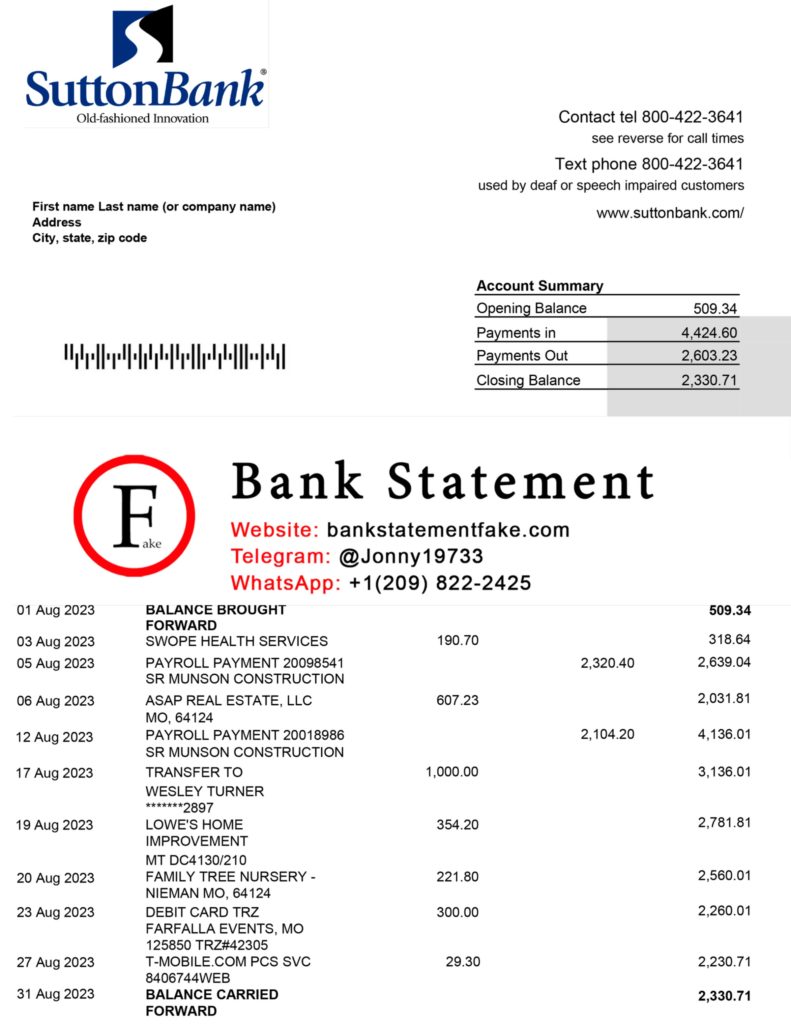

The nonprofit’s goal was to create an interactive program that would engage students in managing personal finances. They needed bank statements that resembled real ones but could be tailored to fit a variety of hypothetical financial situations. Each statement would include different income levels, spending habits, and savings goals, allowing students to practice budgeting, expense tracking, and understanding financial transactions.

Key requirements included:

- Statements that were realistic and easy to read.

- Customizable transaction histories to reflect varied spending scenarios.

- A simple, digital delivery system to provide students with easy access to the statements.

Solution Provided

BankStatementGenerator worked closely with the nonprofit to understand their program objectives and create bank statements tailored to their lesson plans. We developed several customizable templates that allowed for adjustments in income, expenses, and transaction types. Each statement provided students with an accurate depiction of financial statements while remaining flexible for the instructor to modify as needed.

Key features included:

- Realistic bank statement templates, mirroring the layout of genuine documents.

- Pre-filled and customizable transaction sections to align with different financial scenarios.

- Delivery in high-quality PDF format, allowing easy distribution to students.

Implementation and Results

The program integrated these custom bank statements into a semester-long financial literacy course. Students used the statements to practice setting budgets, tracking expenses, and making financial decisions based on their simulated account balances. The statements added a layer of authenticity to the exercises, helping students feel more engaged in the learning process.

The program reported several positive outcomes:

- Students demonstrated improved understanding of income and expense tracking.

- Instructors noted greater student engagement when working with the realistic statements.

- The program showed measurable improvements in financial literacy scores, with over 85% of students passing a post-program financial management assessment.

Conclusion

The case study highlights the value of customized bank statements in educational settings. By providing realistic financial documents, BankStatementGenerator helped the nonprofit create an interactive, practical curriculum that empowered students with essential financial skills. The success of this program underscored the role of custom bank statements in promoting financial literacy.