In the digital age, where document falsification is increasingly common, knowing how to identify a Novelty bank statement is a valuable skill for lenders, borrowers, and others who rely on accurate financial documentation. Novelty bank statements can compromise lending decisions, impact financial integrity, and create costly consequences. This guide provides practical tips to help you identify counterfeit bank statements effectively.

- Look for Visual Inconsistencies

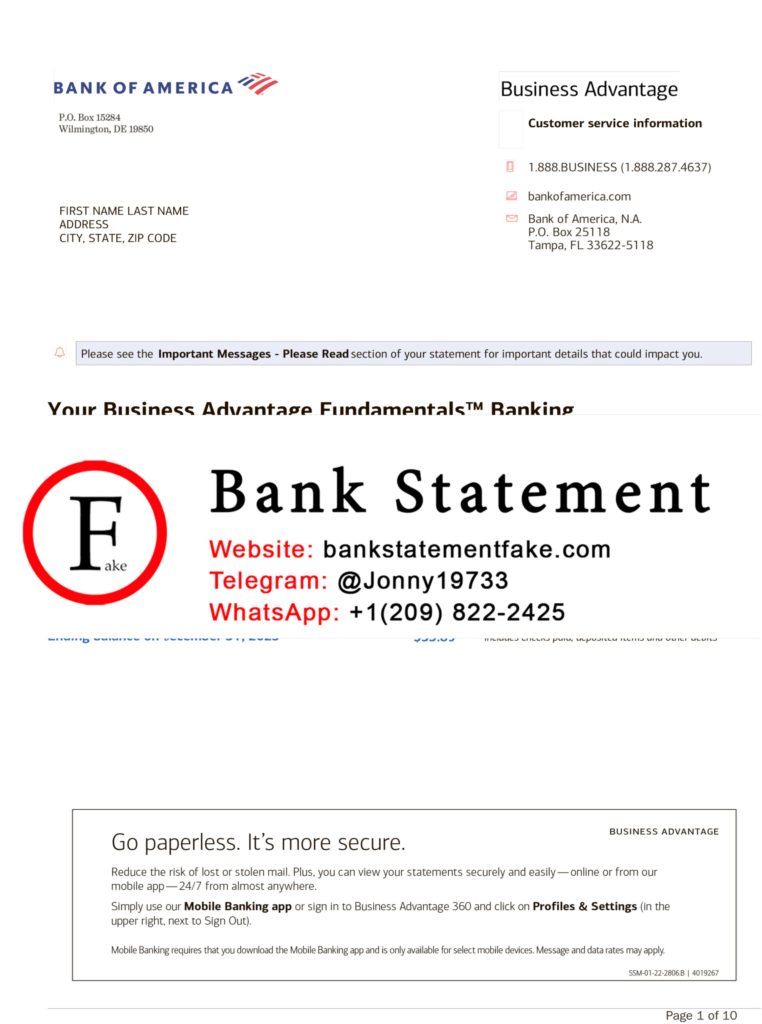

Authentic bank statements follow a specific format with consistent branding elements. Pay close attention to the overall design, font, and layout. Genuine bank statements typically use professional, uniform fonts and high-quality logos that appear crisp and clear. A Novelty bank statement may have blurry logos, mismatched fonts, or inconsistencies in text alignment, indicating that it wasn’t generated by a legitimate financial institution. Sometimes, the spacing or layout may feel “off,” with elements not properly aligned or spaced. Even subtle visual discrepancies can be a red flag that a document may not be authentic.

- Check for Missing Details

Authentic bank statements include comprehensive details, such as the account holder’s name, account number, statement period, transaction list, and contact information for the issuing bank. Each section is essential for identifying the account and verifying its transactions. A Novelty statement might lack some of this crucial information or could present it in an unstructured way. Additionally, authentic statements are typically formatted with a balance summary, transaction dates, and clear identifiers for deposits and withdrawals. If any of these sections seem incomplete or lack important identifiers, it’s worth scrutinizing the document further.

- Examine Transaction Patterns

One of the easiest ways to identify a Novelty bank statement is by looking at the transaction history. Genuine statements reflect realistic spending habits, with a variety of transaction types, amounts, and locations. Novelty statements, on the other hand, often have repetitive or unrealistic transaction patterns. For instance, all transactions may appear as rounded numbers, or the spending may follow a uniform pattern that doesn’t align with typical account usage. Inconsistencies, such as identical amounts for different transactions or a lack of location variety, may indicate the document was fabricated.

- Verify with the Bank

If there are doubts about a bank statement’s authenticity, the most reliable option is to contact the issuing bank directly. Banks can confirm whether an account exists and verify specific details of the statement. This process might take additional time, but it’s an effective step to ensure the accuracy of a document. Financial institutions have dedicated verification teams to address such inquiries, making it easy to clarify suspicious cases. For privacy compliance, this step may require the account holder’s consent, so obtaining written permission can streamline the verification process.

Conclusion: Prioritizing Document Authenticity

Spotting a Novelty bank statement is essential for maintaining trustworthy financial transactions. By paying attention to visual consistency, verifying detailed information, examining transaction patterns, and reaching out to the issuing bank, you can protect yourself and your organization from potential fraud. Implementing these practices strengthens the integrity of financial decisions, ensuring a more secure lending environment for everyone.