Client Profile

A financial coach specializing in personal budgeting and financial wellness wanted custom bank statements for use in client sessions. The coach aimed to help clients understand their spending habits and make informed budgeting decisions through hands-on practice with simulated bank statements.

Client’s Needs

The coach’s objective was to offer clients a realistic view of managing finances by allowing them to work directly with bank statements tailored to their financial goals. Specific needs included:

- Customizable bank statements that could simulate different income and expense patterns.

- Realistic transaction histories for hands-on learning.

- A tool to visually demonstrate the impact of various budgeting strategies.

Solution Provided

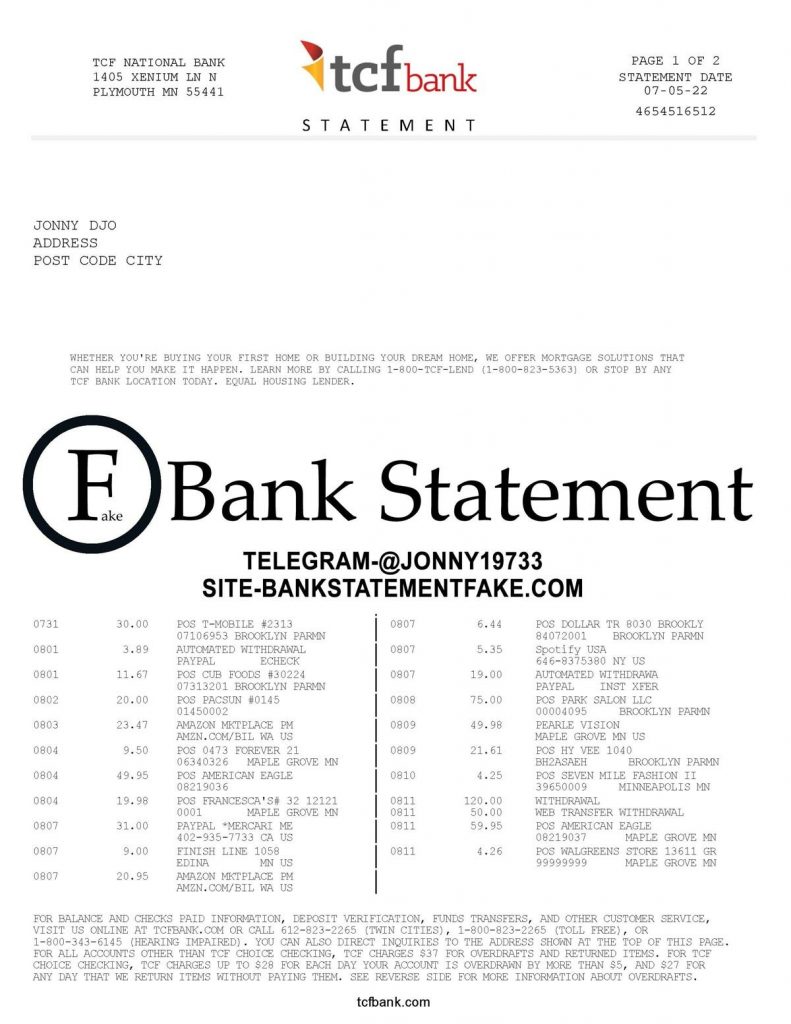

BankStatementGenerator created a set of customized bank statements designed for interactive financial coaching sessions. Each statement reflected hypothetical monthly spending and savings goals, with customizable transaction categories that the coach could adjust based on individual client needs.

Features included:

- Editable income and expense sections to simulate different financial situations.

- Transaction categories relevant to common budgeting scenarios, such as entertainment, dining, and utilities.

- Statements delivered in a digital format for easy access and sharing.

Implementation and Results

The financial coach integrated the custom bank statements into one-on-one sessions, allowing clients to analyze their spending patterns, track cash flow, and see how different budgeting choices would affect their monthly balance. The statements served as powerful visual aids, making budgeting concepts easier to understand and apply.

Clients reported feeling more confident in managing their finances, with 90% of participants showing improved budgeting skills. The coach reported high client engagement and has continued to use custom bank statements as a core part of the service.

Conclusion

This case study highlights the effectiveness of custom bank statements as educational tools in financial coaching. By offering clients realistic financial documents, BankStatementGenerator supported a hands-on approach to budgeting and helped clients build valuable money-management skills.