Client Profile

A financial planning firm needed a tool to help clients visualize their retirement savings projections. The firm required custom bank statements that reflected hypothetical retirement accounts, including regular contributions and investment returns.

Client’s Needs

The goal was to provide clients with a realistic projection of their financial future, specifically:

- Bank statements that simulate retirement account balances.

- Transaction histories showing hypothetical contributions and growth.

- A format that’s easy for clients to understand and follow.

Solution Provided

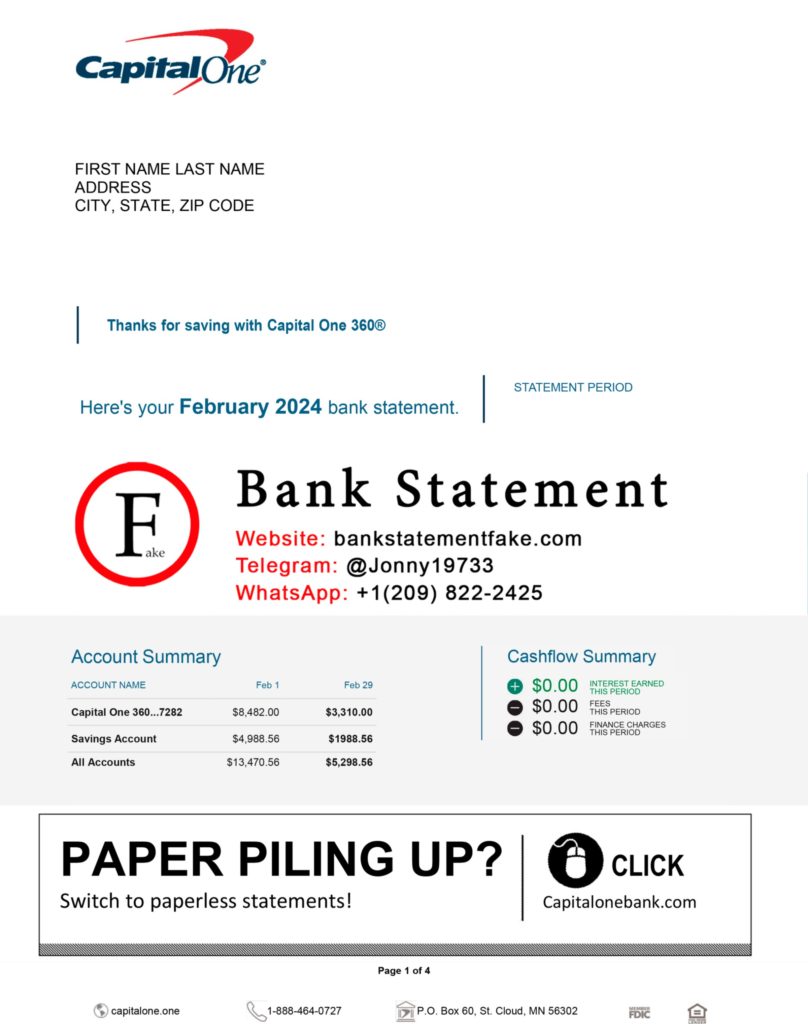

BankStatementGenerator developed custom bank statements that represented retirement savings accounts, with line items for monthly contributions, interest accrual, and growth in balance. The statements were designed to mirror the structure of a retirement account statement, making it easy for clients to track their projected savings.

Features included:

- Accurate formatting to replicate genuine retirement accounts.

- Customizable sections for contributions and projected returns.

- Professional PDF format for client presentations.

Implementation and Results

The financial planning firm integrated these statements into their retirement planning sessions, allowing clients to visually track their projected savings. Clients found the visual format helpful in understanding long-term financial growth, and the firm reported higher client satisfaction and confidence in retirement planning.

Conclusion

This case study illustrates how custom bank statements can assist in long-term financial planning. BankStatementGenerator helped the firm enhance its retirement planning services, supporting clients with valuable projections that promote financial confidence.